30+ House affordability calculator

We use current mortgage information when calculating your home affordability. Mortgage affordability calculator Find out how much house you can afford with our mortgage affordability calculator.

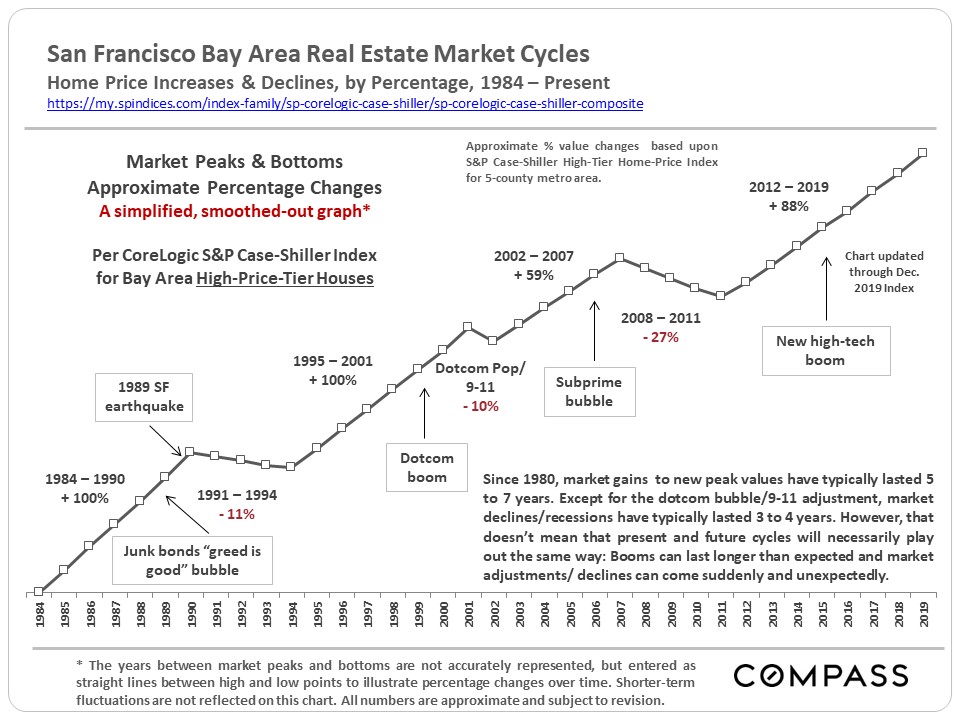

30 Years Of Bay Area Real Estate Cycles Compass Compass

We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

. 13 hours ago. What is your credit score range. Renters in the 16- to 24-year-old age bracket allocate an average of 468 of their gross income each month to renthouseholds in this age group also pay the highest rental prices.

When it comes to calculating affordability your income debts and down payment are primary factors. Using the affordability calculator is really simple you just need to ensure you know the following information first. How to Use the Money Under 30 Car Affordability Calculator.

We assume homeowners insurance is a percentage of your overall home value. One way to start is to get pre-approved by a lender who will look at. 304-30 Thunder Grove Toronto Ontario M1V 4A3 Agincourt North.

Before you start shopping for a new home you need to determine how much house you can afford. In the United States the ideal down payment for a house is 20 but people typically make down payments from anywhere between 5 and 20 depending on the loan. Refine your Toronto real estate search by price bedroom or type house townhouse or condo.

25- and 30-year mortgages. Aside from owing less on your home there are other advantages to putting at least 20 toward your down payment such as not having to pay private mortgage insurance PMI. They are mainly intended for use by US.

The cost is dependent on the price of the house which ranges between 30 to 910. Learn more about how we calculate affordability below. But remember these affordability calculator estimates are used as a general.

To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on. With these details plugged in the affordability calculator will provide you with conservative and aggressive loan estimates. Each scheme has a starting from price for the available property types but if you would like further information you can get in.

Quickly find the maximum home price within your price range. But the exact costs of your mortgage will depend on its length the rate you get and other factors. There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt estimates or fixed monthly budgets.

If you are planning to purchase your dream home or car you must be. Get an estimated home price and monthly mortgage payment based on your income monthly debt down payment and location. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year.

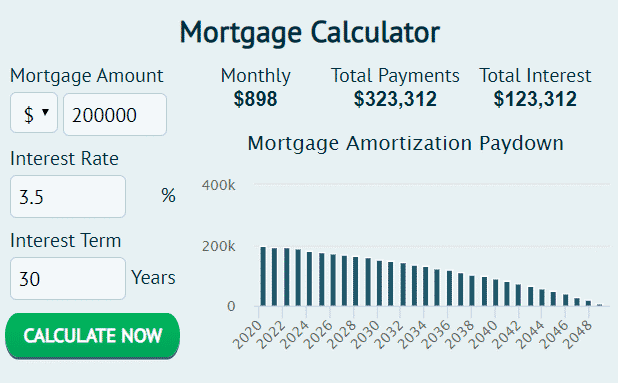

In the example above an additional 100 per month took 15 years off a 30-year mortgage. Try the mortgage calculator to find out how much you can expect to pay on a 15-year mortgage compared to a current 30-year mortgage. The Mortgage Affordability Calculator estimates a range of home prices you may be able to afford based on the accuracy and completeness of the data and information you enter.

While your personal savings goals or spending habits can impact your. Fees Charges 0 025L 05L 0. How much is the monthly payment aka EMI for my loan.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. This interactive affordability calculator is designed to help you determine how much house you can afford. 7130 Homes for Sale in Toronto Ontario.

While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. Rent Affordability by Age Not surprisingly young adults earning entry-level wages spend the highest proportion of their earnings on rent payments. See the results below.

Why use this calculator. 750 Above 700-749 550-699 550 Below What is your credit score range. Today 15-year mortgage payments are comparable to 30-year mortgage payments at the higher interest rates.

To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts. Factors that impact affordability. You dont have a trade-in and you choose a 48-month loan at 4.

The VA loan affordability calculator is set to the top end of the VAs recommended DTI ratio of 41 percent. For a 300000 house 30-year mortgage at a 35 interest rate having a 60000 down payment youd pay around 1078. The multi-purpose loan calculator is a 4-in-1 calculator that aims to answer your questions such as.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Likewise a more expensive home requires a higher land registry fee. The amount of time you have to pay back the loan either 10 15 or 30 years.

The results are intended for illustrative and general purposes only and do not constitute nor should they be relied upon as financial or other advice. Lets pretend that you make 40K a year. Loan Amount Calculator Loan Affordability Calculator.

In addition to using the above affordability calculator you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios. View up-to-date MLS listings in Toronto. Your budget is 35 or 14000 and you plan to make a 20 down payment of 2800.

Our calculator uses information from you about your income monthly expenses and loan term to calculate an estimate of what you may be able to afford. Annual real estate taxes. Trent Park has a minimum of 30 for the share whereas Leon House only requires 25.

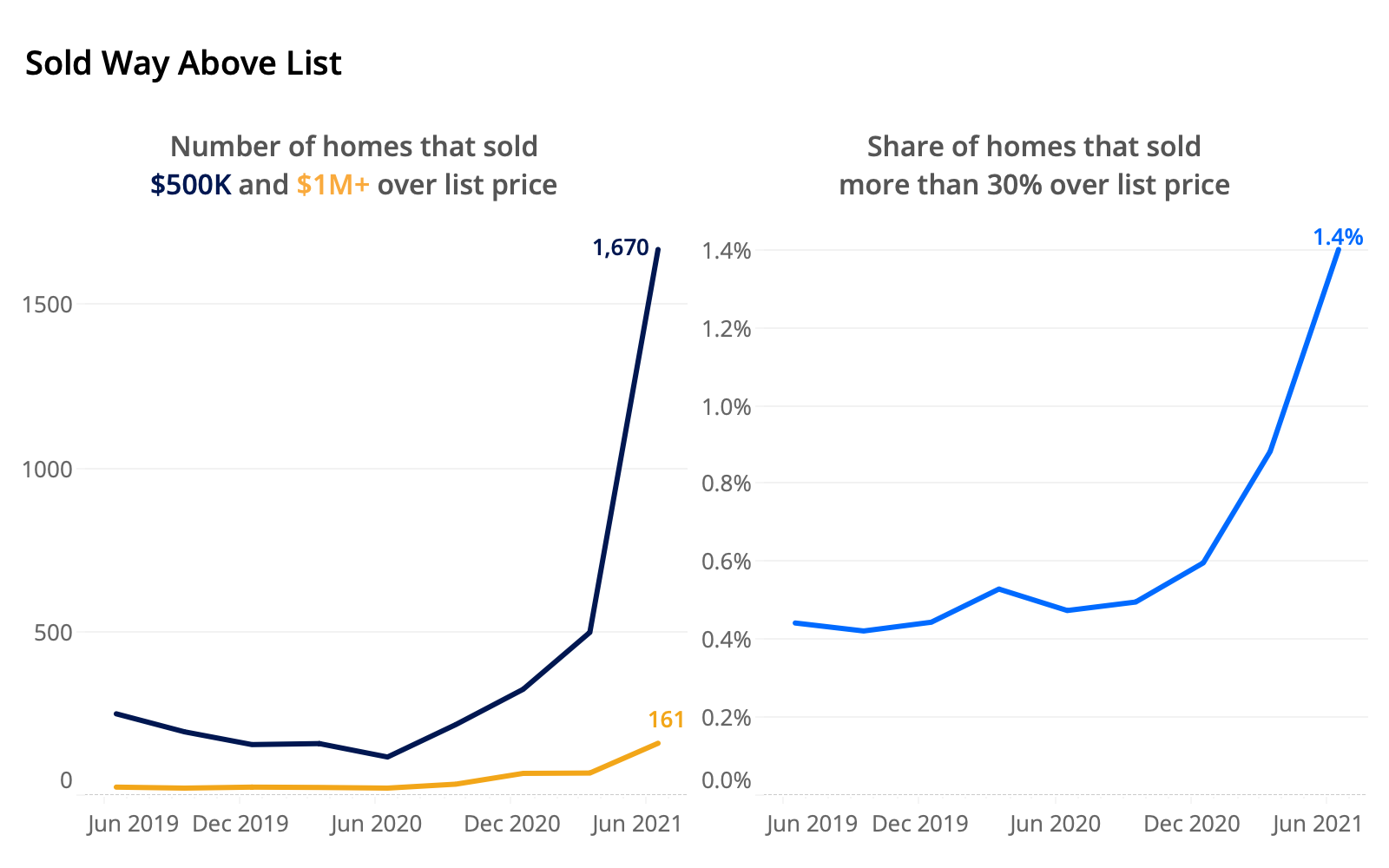

Share Of Homes Sold Way Over List Doubles Zillow Research

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

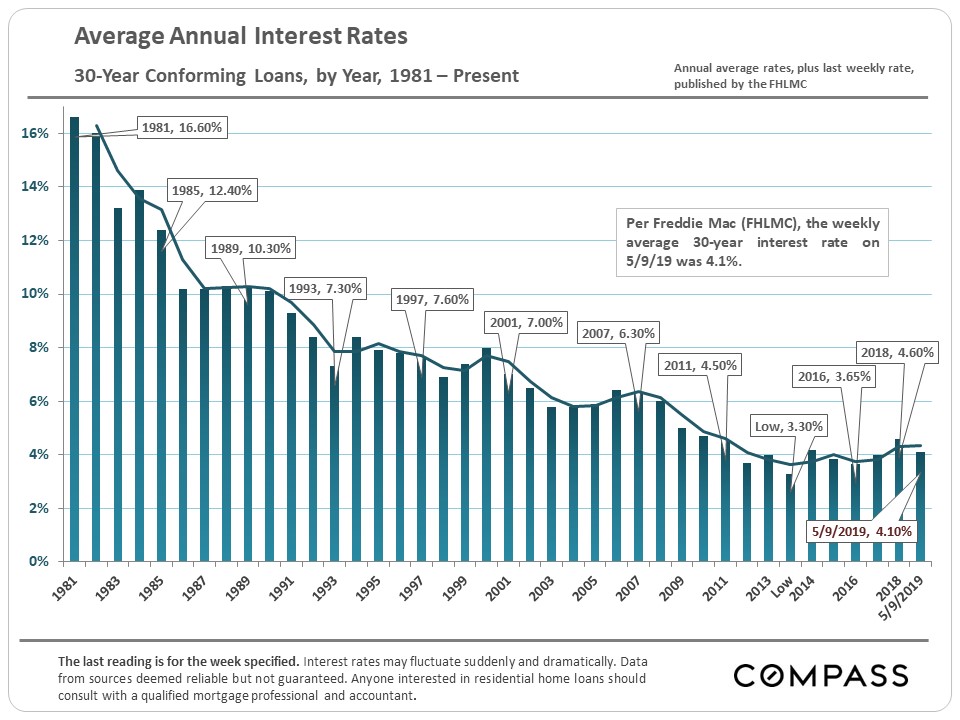

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

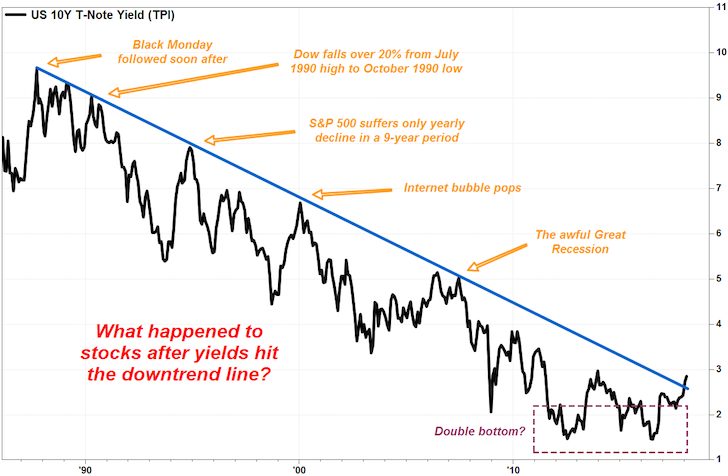

What S Going On With Housing Pacific Capital Associates

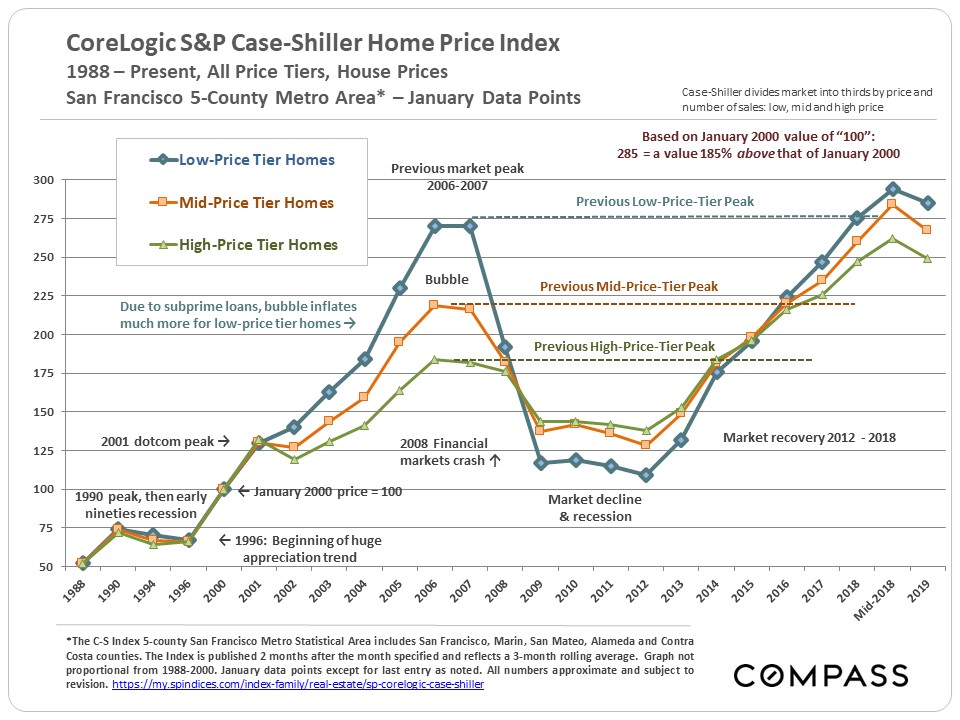

30 Years Of Bay Area Real Estate Cycles Compass Compass

30 Years Of San Francisco Bay Area Real Estate Cycles

Recessions Recoveries Bubbles 30 Years Of Housing Market Cycles In San Francisco Marin Home Team Paragon Real Estate

Recessions Recoveries Bubbles 30 Years Of Housing Market Cycles In San Francisco Marin Haven Group

Recessions Recoveries Bubbles 30 Years Of Housing Market Cycles In San Francisco Marin Home Team Paragon Real Estate

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Real Estate Calculators Mortgage Rent Vs Buy Affordability More

30 Years Of Bay Area Real Estate Cycles Compass Compass

Filtering Oregon Office Of Economic Analysis

30 Years Of Bay Area Real Estate Cycles Compass Compass

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Years Of Housing Market Cycles In The San Francisco Bay Area

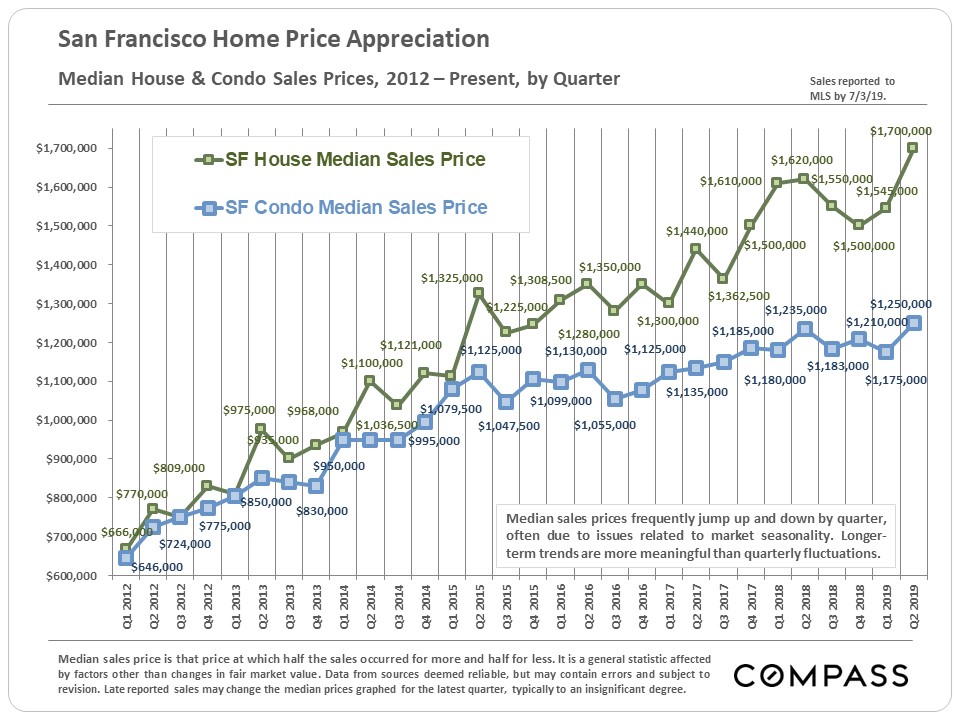

San Francisco Bay Area Housing Affordability Home Team Paragon Real Estate